The movement for sound money is gaining unprecedented traction across the U.S., with more states introducing and passing legislation to facilitate the use of gold and silver as money.

Mike Maharrey, a reporter and analyst at Money Metals Exchange, recently sat down with Jp Cortez, Executive Director of Money Metals’ Sound Money Defense League, to discuss the state of the movement, legislative victories, and the ongoing battle against inflationary policies that erode the value of the U.S. dollar.

(The Interview Starts Around the 5:28 Mark)

The Sound Money Defense League: A Decade-Long Battle

Founded in 2014 and primarily funded by Money Metals Exchange, the Sound Money Defense League (SMDL) is a national public policy group dedicated to reintroducing gold and silver as legal money. Their mission focuses on removing the taxes and regulatory burdens that hinder individuals from using or investing in precious metals.

"Everything else that could function as money has been saddled with taxes and disincentives," Jp Cortez explained, emphasizing how the current monetary system traps people in the Federal Reserve’s fiat currency.

Over the past decade, the SMDL, with the leading efforts of Jp Cortez, has worked to pass legislation at both the state and federal levels.

In 2023, their efforts resulted in seven states successfully enacting sound money policies—making it their most productive year yet.

This year, they have already seen a significant increase in state-level engagement.

The Power of State-Level Policy

Maharrey, who also works with the Tenth Amendment Center, noted a growing interest in sound money legislation over the last two years. He attributes this to increasing public awareness of inflation and the monetary debasement caused by the federal government's policies.

Cortez highlighted the strategic importance of focusing on state-level legislation rather than federal efforts, explaining that grassroots activism can yield real results in state capitals. He pointed out that state legislators are more accessible to constituents than members of Congress, and state policy often influences federal action.

As evidence of this, he cited the recent legislative surge:

"Ten years ago, only a handful of states were considering sound money policies. Last year, more than 27 states introduced over 65 bills related to sound money."

Wyoming’s Gold Reserve Victory

One of the most significant victories this year occurred in Wyoming, where Senate File 96 became law without Governor Mark Gordon’s signature. The legislation establishes a $10 million gold reserve for the state—securely stored within Wyoming.

Governor Gordon, however, voiced opposition, releasing a two-page letter criticizing the bill. He argued that gold is not a good investment, claiming its only value is selling it at a higher price. Despite his reluctance, the legislature’s decision sets a precedent for other states considering similar measures.

Wyoming joins Utah and Tennessee in stockpiling gold, with Utah holding nearly $50 million in physical gold and Tennessee having recently passed legislation empowering its state treasurer to invest in gold.

More States Join the Sound Money Movement

Beyond Wyoming, several other states are making progress:

- North Dakota is considering a bill that would allocate 1% of all state funds to gold reserves—roughly $10 million. The state treasurer expressed openness to the idea, a promising sign.

- Montana is actively reviewing legislation to eliminate all taxes on gold and silver.

- Maine is reintroducing a bill to remove sales tax on precious metals after a narrow defeat by one vote in 2022.

- Kentucky is facing a legal battle after its governor unconstitutionally vetoed a bill that repealed the state’s sales tax on precious metals. This year, legislators are reintroducing the repeal while also introducing measures to establish a state gold reserve and provide a legal avenue for taxpayers to sue the governor over wrongful taxation.

- Alabama is working on a bill to reaffirm gold and silver as legal tender, following previous legislative successes that repealed sales and capital gains taxes on precious metals.

These legislative efforts reflect a growing realization that gold and silver provide protection against inflation and monetary instability.

The Push for a Full Audit of Fort Knox Gold

At the national level, the issue of America’s gold reserves is gaining attention. The U.S. officially claims to hold over 8,000 tons of gold, making it the largest holder of gold reserves in the world. However, many—including members of Congress—are questioning whether this gold is actually present and unencumbered.

The last comprehensive audit of Fort Knox occurred in the 1970s, but it lacked thorough verification. No assays were performed, serial numbers were not cross-checked, and there was no independent review of ownership.

In 2019 and 2021, SMDL worked with Congressman Alex Mooney (R-WV) to introduce the Gold Reserve Transparency Act, which called for a full audit of U.S. gold reserves. The bill emphasized the need for a physical inventory, a review of all transactions involving U.S. gold, and an examination of whether any of the gold has been swapped, leased, or otherwise encumbered by foreign or financial institutions.

With growing support from figures like Donald Trump, Elon Musk, Senator Mike Lee, and Ron Paul, the push for a full audit is gaining momentum. Cortez warned against another theatrical audit like the one in the 1970s, where select bars were showcased for cameras without verifying the entire reserve. He emphasized that U.S. gold holdings must be properly accounted for to restore public confidence in the economy.

The Road Ahead: Grassroots Action is Key

Cortez and Maharrey stressed that public engagement is crucial to advancing sound money policies. The Sound Money Defense League provides an easy way for individuals to get involved through their legislative action list, which alerts subscribers to relevant bills in their states and provides contact information for key legislators.

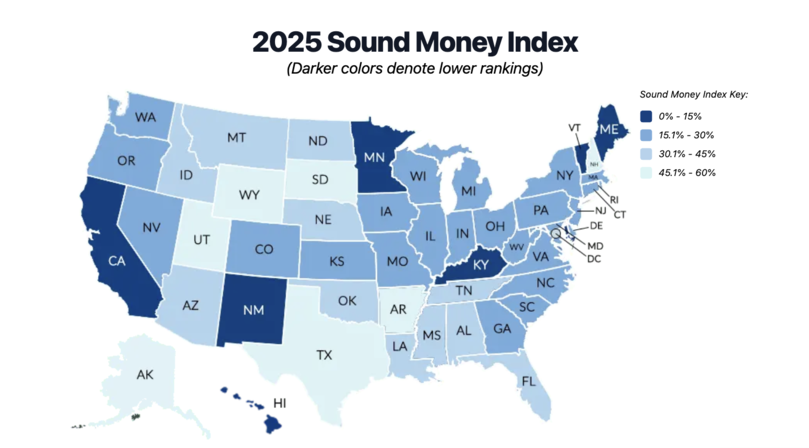

The Sound Money Index, published annually by Money Metals Exchange and the Sound Money Defense League, ranks all 50 states based on their sound money policies. Those in poorly ranked states are encouraged to take action by contacting their representatives and advocating for tax repeals, gold reserves, and legal tender laws.

As Maharrey noted, small policy changes build upon one another, and grassroots action has already resulted in major victories. With inflation eroding the value of fiat money, the fight for sound money is more important than ever.

Get Involved:

- Visit the Sound Money Defense League: www.soundmoneydefense.org

- Sign up for legislative action alerts to be notified about key bills in your state.

- Check your state’s ranking on the Sound Money Index by Money Metals and the Sound Money Defense League

- Contact your state legislators and advocate for gold and silver-friendly policies.

The battle for sound money is far from over, but with increasing public awareness and legislative momentum, states across the country are taking crucial steps toward monetary freedom.

Key Questions & Answers

The following are the key questions and answers from the Money Metals podcast interview with host Mike Maharrey and Sound Money Defense League’s Executive Director Jp Cortez:

What is the Sound Money Defense League (SMDL) and its mission?

The Sound Money Defense League (SMDL) is a national public policy group primarily funded by Money Metals Exchange. Its mission is to remove taxes and regulations that hinder the use of gold and silver as money. The organization works at both the state and federal levels to introduce and pass legislation that allows individuals to invest in and transact with precious metals more easily.

Why is the focus on state-level policy rather than federal policy?

State-level efforts are more effective because legislators are more accessible to constituents. Calling a congressman may not yield results, but grassroots advocacy at the state level can make an immediate impact. Historically, policy changes at the state level often influence federal action, making this a more strategic approach for advancing sound money policies.

What was the significance of Wyoming’s gold reserve legislation?

Wyoming recently passed a law creating a $10 million gold reserve, securely stored within the state. The bill became law without Governor Gordon’s signature, as he opposed it but chose not to veto it. This decision sets a precedent for other states considering similar measures and reinforces the growing momentum for state-owned gold reserves.

What other states are making progress on sound money legislation?

North Dakota is considering a gold reserve plan similar to Wyoming’s, allocating 1% of all state funds (roughly $10 million). Montana is reviewing legislation to eliminate all taxes on gold and silver. Maine is reintroducing a sales tax repeal bill after a previous attempt failed by just one vote. Kentucky is challenging its governor’s unconstitutional veto of a sales tax repeal and is pushing forward with additional sound money policies. Alabama is working on reaffirming gold and silver as legal tender.

Why is auditing the U.S. gold reserves (Fort Knox) important?

There has not been a credible, comprehensive audit of U.S. gold reserves since the 1970s. Previous audits have only checked external seals rather than verifying the actual gold bars. There are growing concerns about whether the gold is physically present and whether it has been swapped, leased, or otherwise encumbered by financial institutions.

What legislation has been introduced to audit U.S. gold reserves?

The Gold Reserve Transparency Act, originally introduced with Rep. Alex Mooney, calls for a full audit of U.S. gold reserves. The bill mandates physical verification, serial number checks, and a full accounting of any financial transactions involving the gold. With recent support from Donald Trump, Elon Musk, Senator Mike Lee, and Ron Paul, the movement to audit Fort Knox is gaining significant traction.

What role does grassroots activism play in advancing sound money policies?

Citizen engagement is crucial in passing sound money legislation. Many bills are ignored unless constituents actively push for them. The Sound Money Defense League provides resources to make it easy for people to contact state representatives, sign petitions, and support legislative efforts. Small victories at the state level build momentum for broader policy changes.

Where can people learn more and get involved?

People can visit www.soundmoneydefense.org to stay informed, sign up for legislative action alerts, and check the Sound Money Index to see how their state ranks on sound money policies. The site also provides contact information for state legislators and tools to advocate for pro-gold and silver policies.