With inflation still at high levels, it is becoming overwhelmingly evident to Americans that Federal Reserve notes steadily depreciate in value as a form of currency.

For example, an item that cost a silver dollar in 1913 – the year the Federal Reserve and federal income tax (16th Amendment) began – would cost close to $31.00 unbacked dollars today, as pointed out recently by Dr. Thomas L. Hogan.

In contrast to today’s ubiquitous fiat currency, specie money was available to our recent ancestors and consisted of coins made of gold, silver, and copper that were stamped with a monetary value and deliverable to holders of paper bank notes when taken to a bank for redemption.

This historic form of money (i.e. commodity money or specie) dominated the world as the primary means of exchange while holding its value and helping provide economic stability.

As renowned Austrian economist Carl Menger explained, specie money emerged spontaneously through the actions of individuals. It was not conceived by a single person or government, and no government compulsion was necessary to transition from a barter system to a sound money economy.

Coins minted in the United States, as well as those from countries like Spain, Mexico, Great Britain, France, and Portugal, contributed to the realm of specie money and were commonly used in global and domestic trade.

The Coin of the Realm in the United States

Article 1, Section 8 of the U.S. Constitution grants Congress the power to coin money and fix the standard of weights and measures.

Through The Coinage Act of 1792, Congress ordered the construction of the United States Mint and made it responsible for minting the coins of the United States.

Nine months later, Congress passed The Act of February 9, 1793, declaring that foreign coins would be legal tender within the United States of America for three years while its national mint produced sufficient coins for domestic circulation.

The foreign coins mentioned in this Act remained in use for much longer than three years, and privately minted coins, especially those minted of gold, also circulated in the United States until the latter half of the 19th century. (Ultimately, Congress banned the private coining of money in 1864.)

Other than a short period around the Civil War, American bank notes also remained formally tied to precious metals throughout the 1800s, exchangeable in specie coins minted of gold or silver bullion.

This financial system backed by both gold and silver was known as bimetallism and was widely adopted across the globe.

Lasting remnants of readily available U.S. specie money include pre-1933 gold $20 Double Eagles, $10 Eagles, $5 Half Eagles, and $2.50 Quarter Eagles. Most of these items are sold today near their gold melt value – but some may command a higher collectible value if they are in excellent condition or minted in particular years.

Other Constitutional silver coins, commonly known as "junk silver," were minted before 1965 and are a great low-cost option for investing in silver specie coinage today.

These coins were minted of 90% silver and 10% copper in 1964 and prior (pre-1965), and include Half Dollars, Quarter Dollars, and Dimes. Peace Dollars and Morgan Dollars are commonly found as well.

Even copper pennies minted before 1982 (when virtually all of the copper was swapped out for cheaper zinc) are stockpiled by some value-minded savers.

Those looking to invest in specie can also look abroad, to French 20-Franc gold coins, British gold Sovereigns, Mexican 20-Peso gold coins, and more.

Fiat Money Drove Specie Money Out of Circulation

Gresham's Law predicts that "good money" will be driven out of circulation by "bad money."

Through government actions, specie money was systematically replaced by Federal Reserve notes and clad coinage throughout the 20th century.

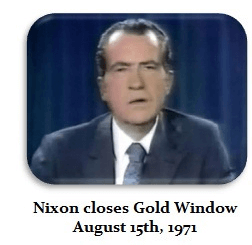

The last link to gold was severed by President Richard Nixon in 1971 whereupon the United States “temporarily suspended” (i.e. “permanently defaulted on”) the convertibility of the dollar as prescribed by the Bretton Woods Agreement between the world’s major central banks.

Today’s unbacked Federal Reserve note – still referred to as a "dollar" even though it does not meet the historical definition (372.5 grains of silver or about 0.775 troy ounces) – has now lost a staggering 98% of its purchasing power since the establishment of the Federal Reserve in 1913.

Modern-day paper currency (and its electronic equivalents) have long since been irredeemable in specie, making it a cinch for the government to issue this fiat currency as legal tender with reckless abandon.

As we live in an Age of Inflation, specie money reminds us that a more stable and sound monetary system once existed – and is possible for us to return to once more.