Precious Metals Dealer, Sound Money Group Rank all 50 States’ Gold and Silver Policies

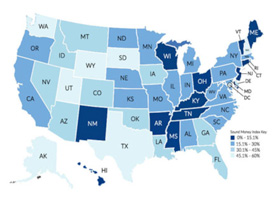

Charlotte, NC (December 22, 2020) – Wyoming, Texas, and Utah are the three most pro-sound money states in the United States, according to the 2020 Sound Money Index.

Released today, the Sound Money Index is the first index of its kind and uses 12 different criteria to determine which states maintain the most pro- and anti-sound money policies in the nation.

The Sound Money Index evaluates each state’s sales and income tax policies involving precious metals, whether a state recognizes the monetary role of gold and silver under the U.S. Constitution, whether a state holds pension, reserves, or bonds in gold or silver, whether a state has imposed precious metal dealer/investor harassment laws, and other criteria.

Money Metals Exchange, a national precious metals dealer recently ranked “Best in the USA,” and the Sound Money Defense League, a national, non-partisan sound money advocacy group joined together to produce the authoritative ranking.

Because a handful of Washington State politicians failed again this year in their attempts to impose sales taxes on purchase of the monetary metals, the Evergreen State joins South Dakota, Alaska, and New Hampshire in the fourth to seventh place range on the Sound Money Index.

Ohio fell to the bottom of the rankings last year after slapping sales taxes on gold and silver, but the Buckeye State made a minor comeback in 2020 when its government pension trustees decided to allocate five percent of retirement funds to physical gold.

Ohio joins Texas as the only two states in the U.S. known to allocate a percentage of state-held pension funds to physical gold, even though other pension trustees’ failure to own gold as financial insurance arguably violates their fiduciary duties as well as the “prudent man rule.”

According to the 2020 Sound Money Index, the very worst environments for sound money can be found in Vermont, Arkansas, New Jersey, Maine, and Tennessee. However, Arkansas, Maine, and Tennessee are expected to consider bills that would improve their rankings in their upcoming 2021 legislative sessions.

"As politicians and central bankers continue to print trillions of unbacked pieces of paper in response to COVID, sound money has never been more important. Citizens in states that foster pro-sound money environments enjoy the benefit of being able to protect their wealth without onerous taxes and regulation," said Jp Cortez, Policy Director of the Sound Money Defense League.

“Federal policy and the Federal Reserve System are the root causes of inflation, instability, and currency devaluation,” said Stefan Gleason, President of Money Metals Exchange.

“However, many states are taking steps to protect their citizens from the damaging effects of America’s fiat paper money system,” Gleason noted.

The complete 2020 Sound Money Index is available here.

About the Sound Money Defense League and Money Metals Exchange:

The Sound Money Defense League is a non-partisan national public policy group working on the state and federal level to bring back gold and silver as America’s constitutional money.

Money Metals Exchange is a national precious metals company recently named “Best in the USA” by an independent global ratings group and serves over 200,000 investors in physical gold, silver, platinum, and palladium. For more information, please visit https://www.moneymetals.com/.